Join us for a webinar on Oct 10 to learn how Bidgely is "Empowering Utilities with GenAI:

A Guide to Enhanced CX and Grid Management". Register here.

DER deployments will accelerate as cost of ownership continues to fall and wholesale markets unlock additional benefits, whether utilities choose to take an active role or not. And, the longer utilities wait to engage DERs at an enterprise level, the more difficult and expensive it will be to coordinate and manage rapid DER expansion on their grids.

Bidgely offers utilities a roadmap to successfully navigate — and more importantly benefit from — the DER revolution.

Energy providers need to know where DERs are located on the grid, their size, and how they’re being operated — preferably on a real-time or near real-time basis. This is especially true for customer-sited DERs and behind-the-meter DERs, where utilities typically have little to no visibility.

Applying sophisticated algorithms to AMI data makes it possible to learn how customer net generation is moving onto and off of the grid, and understand the characteristics of their residual behind-the-meter demand across household appliances and mechanical systems. Bidgely’s patented disaggregation algorithms powered by our UtilityAI® platform deliver a high fidelity profile of every end-use present in a household or small business. Utilities can determine with certainty if and how a customer is using a PEV, a rooftop solar system with battery storage, a heat pump water heater, and more.

Utilities typically rely on grid monitoring and analysis tools that focus on the distribution system and go as deep as the low voltage lines. That approach only shows half the picture. Demand data disaggregation and analytics are critical additions to the tool kit for any utility that’s serious about planning, deploying, and operating a two-way communicating, decentralized grid. Just because the traditional distribution system analysis shows you CAN invest in a distributed resource at a certain location, doesn’t necessarily mean you SHOULD.

For example, a hosting capacity analysis may show that a feeder can handle an additional 15 MW of distributed capacity, so a third party solar developer signs up to build it. However, disaggregated load data may reveal that most of the non-shiftable load on the feeder doesn’t match well with the duck-curve load the solar resource will provide. Or it reveals that there is an additional 10 MW of behind-the-meter DERs on the feeder that could be utilized to boost the hosting capacity to 25 MW, allowing additional technology types and configurations for utility DERs deployments on the feeder. Or, maybe the disaggregated data reveals a consistent end-use demand on a different feeder that more closely matches the export load shape of the solar resource offering a more efficient and effective deployment location.

Wholesale markets have already started opening to DERs this summer, and third-party aggregators are already on the scene signing up utility customers into their own wholesale programs. There is an urgent need right now for utilities to get a handle on who is participating and how. It’s possible that a utility that fails to fully engage in this opportunity might one day buy day-ahead, or spot market wholesale power aggregated from its own customers.

That example may seem far fetched, afterall FERC Order 2222 requires extensive coordination between distribution utilities, RTOs/ISOs, aggregators, and state regulators in order to streamline the integration of DERs into wholesale markets. And utility scale DERs deployments will be captured through interconnection agreements, and monitored through the inverter technology required to connect them to the grid.

But what about all the customer-sited and behind-the-meter DERs? Bidgely’s near-real-time DER usage behavior, pattern and trend data provides utilities and regulators with an invaluable single source of truth that ensures all parties are on the same page.

As well, this new policy reality is creating a blurred line between wholesale and retail markets, and it’s essential to equitably allocate costs between retail customers, DER owners, and aggregators. Bidgely’s data science empowers utilities to create granular and nuanced rate structures to successfully balance cost recovery — maintaining a safe, reliable grid system, and appropriately compensating DER owners for their resources. Bidgely’s DER insights inform responsive and hyper-targeted tariff structures to avoid a mismatch between rates and cost to serve, mitigating concerns over cross-subsidization and ensuring equity goals can be achieved.

Analytics-driven demand response programs have the power to alleviate congestion on transformers and substations in a more agile and scalable way by shifting the highest propensity end-uses within a given load profile and location.

For example, legacy demand-side management approaches might offer all customers within a congested area an incentive to shift their EV load. But not every customer in that area will have an EV, and among those who do, it is likely that many are already charging off-peak (or at public stations/work). Bidgely’s AI-powered data analytics allow energy marketers to pinpoint which customers have an EV and when they are charging at home. With those insights, energy providers can focus demand response programs to compensate these customers in proportion to their load contribution to realize greater grid benefit.

Demand response programs must also evolve from focusing unilaterally on reducing load to a two-way provision of flexible load and supply. BIdgely’s more agile and hyper-personalized approach to customer engagement plays an essential role in empowering utilities to influence where, when, and how customers use energy.

Current “business as usual” approaches to grid modernization and beneficial electrification are likely to take 20-plus years to complete, in direct conflict with more aggressive decarbonization timelines.

To accelerate this progress, Bidgely is working with utilities worldwide to leverage their AMI data to develop bottom-up, baseline views of their grids and plot roadmaps for truly distributed, two-way communicable grids. With a data-enabled foundation, it is possible to scale DER investments very quickly and shrink modernization timelines to 10 years or less.

Energy customers are deploying DERs at an increasing pace, and rules like FERC 2222 and massive investment programs like the IRA and IIJA are unlocking new revenue streams, which will have many third parties vying to engage customers in aggregation and integration programs that promise to ramp DER adoption even faster.

That’s why immediately harnessing demand data to catalog and deploy the variety of energy services DERs provide, and scale and optimize DERs across the grid is an imperative.

For more DER program strategies, download the full Navigating the Distributed Energy Resources Revolution: A Playbook to Guide Grid Modernization and FERC 2222 Compliance. Behind-the-meter, demand-side data has the power to enhance outcomes and increase the value of distributed resources utility-wide, but the time to act is now.

In the third episode of Bidgely’s 2022 Engage+ video series, host Neil Strother has a conversation with Charles Spence, Customer Programs and Products Manager at Avangrid, to explore how utilities can leverage meter intelligence to design long-term EV strategy that is both cost effective and flexible.

“We know these EVs are coming, and they are going to be a demand on our system,” said Spence. “Our biggest challenge is obviously integrating that load both on a volume basis and on a timing basis. The issue there being that the system is designed for those peak moments, and we have end-of–day peaks already, when people come home, they turn on their AC, TV, all these things, and now when they plug in that EV it will create an issue where it’s not just the volume, it’s the time. That is what we’re trying to do with our demand response managed charging programs.”

Spence emphasized that data analytics is serving as the foundation for Avangrid’s EV approach.

“We’re interfacing with a lot of different types of people, usage patterns and new technologies, and we have to be able to understand what’s going on on a very granular level, specific to each customer, in order to predict what they are going to do what and how they are going to interact with the programs or platforms that we create. That’s why we leverage data all along the way,” he explained. “It informs programmatic changes and platform changes, from offering new features or incentives to tracking each customer’s progress, and then being able to aggregate those insights to see how our program is performing compared to the goals that we have. Ideally, these insights allow us to adjust on the fly if things are not going the way we want them to.”

Spence went on to describe what his team is learning through one of Avangrid’s first demand response charging programs – a Bidgely partnership.

“In Connecticut we have 100% or close to 100% AMI coverage. So we are able to utilize that household energy data for a number of different purposes – primarily through disaggregation. We’re able to pull apart that historic data, identify people who likely do have an EV and offer those customers opportunities,” he said. “We are able to then see which customers are on the more constrained circuits and say, ‘Hey, that neighborhood has 20 Teslas in it, let’s see about getting them into the program.’ For our demand response programs, we’re able to verify if somebody is participating or not, and when they receive price signals, if they actually respond or not. Because we can see where EV use is concentrated, that data also guides us in upgrading the grid in a given neighborhood or section of our market.”

Spence went on to talk about the many flavors of managed charging programs that are possible, ranging from pure demand response to more active managed charging.

“The program we’re initiating with Bidgely in Connecticut is a pure demand response program, which you could consider to be a subset of the broader managed charging umbrella. We’re looking at how we integrate EV load and time it well,” he said. “On the one hand, you could do a demand response event a few times a month, during very specific hours in a day, for which customers receive a warning ahead of time. On the other hand, you could have a more active managed charging program in which the customer sets the amount of charge that they need, and they tell us what time they need that charge. And then we use smart algorithms to facilitate that charging on a very granular basis -– more so than just turn it off for two hours, turn back on after those two hours. Through that active managed charging, we will be able to get that new load under control. That’s what we’re working on with Bidgely right now.”

When it comes to lessons learned, Spence said that Avangrid, like energy providers worldwide, is still evaluating best practices.

“I think the industry is trying to figure out what works best for what contexts in what territory,” he acknowledged. “Every territory is different. Some have more constrained circuits and some need more heavy-handed programs than others. For this first year of the program, we’re setting ourselves up to be able to do a maximum of 15 events per month. I doubt we’ll ever call that many in a month, because that’s one every two days. But we’re giving ourselves that ability to be able to test with a couple groups of customers. For example, one group might get one event and then one immediately the next day. Another might get one on Monday, and then on Wednesday. A third might get one on Monday, and then one on Thursday. We want to see how participation does or does not drop off. If it does, we’ll be able to make programmatic changes and really get some great insights. We’re trying to build understanding for everyone in the industry at this point.”

Spence went on to discuss Avangrid’s next managed charging program roll out in New York state.

“We are soon going to be launching a very similar program in New York, except that we’re adding managed charging to the demand response,” he described. “We’re giving customers the option to either respond to signals on a basic level where they might earn if they decide not to participate on a given day. Or, they can opt-in to a more active managed charging program where people are earning more, but are also expected to allow us more flexibility to control their vehicle to a greater degree.”

Looking down the road past the program evaluation phase, Spence says Avangrid is simultaneously planning for the technology available today as well as what’s on the horizon – including how energy providers and consumers will increasingly work together.

“In terms of the broader strategy, we are thinking about the managed charging and the demand response programs that we can implement now. But we’re also cognizant of the fact that there’s vehicle-to-grid technology coming soon,” he said. “The vehicle-to-grid stuff is excellent. It’s an opportunity to evolve the utility customer relationship to a point where, rather than us selling kilowatt hours exclusively, consumers will also be able to sell them back to us. And we’ll have a nice little dynamic there.”

Spence said he is also looking forward to the broader adoption of telematics and its potential to inform grid planning.

“Telematics basically gives us the use of the onboard EV computer. Some models have a stronger capability where you don’t only see the data, you can also turn the charger on and off, and understand where people are charging and how much they’re charging. We’re using telematics not only for direct load control — where we turn off charging for a demand response event or throttle it slightly — but also to understand charging behavior outside the home charger. Most charging happens at home, but there is 20 percent-ish that happens elsewhere. And that is huge. Public charging generally occurs in constrained urban areas, which are the same places where grid upgrades are most expensive and the most disruptive to people’s lives. We want to avoid digging up concrete as much as possible. If we’re putting level-two, or even DC fast charging out in these contexts, we want to know who’s using it, when they’re using it, and how they’re using it. And telematics enables that.”

Spence pointed out that, because Avangrid is a subsidiary of the global Iberdrola group, they have a unique advantage in that they can learn from the EV experience of their European counterparts.

“We do get quite a bit of support,” Spence acknowledged. “We know that folks in the various European countries are there to answer questions and we can count on their assistance with EV messaging and knowing how to position EV programs in a way that speaks to people both in a value sense, but also in empathetic sense, to improve engagement.”

When asked what it takes to get EV strategy right, Spence replied that, “There are all sorts of ways we could measure success. Fundamentally, we have to get the load integrated and timed properly. But beyond that, we have to really work through that change in the utility-customer relationship. We have to move from an approach where we just send a bill to one where we have a little bit of back and forth with our customers. If we’re going to integrate the load that we are expecting, we have to have participation and buy-in from the customer, and that requires trust, ease of participation, meaningful insights, and lifestyle and financial help as well. If we’re, for example, going to get somebody to, on a regular basis, let us turn off their EV charging for a couple of hours several times a month, they need to know that we are going to be providing them with value — both monetary and lifestyle.”

If you’d like to hear more from Avangrid about its data-driven EV strategy, watch the full Engage+ episode on demand and sign up now to receive updates about future episodes.

Accurate demand forecasting enables critical utility functions ranging from purchasing energy at a lower cost, avoiding black and brownouts, developing dynamic rate structures and implementing more effective demand response programs.

But as the grid grows exponentially more complex, accurate demand forecasting is becoming more challenging, and a greater imperative, than ever before.

Distributed energy resources like solar and wind are shifting the predictability of energy generation, while an increasing number of consumer electric vehicles (EV) and large-scale EV fleets are introducing more variability and greater peaks on the demand side.

Thankfully, new AMI data is at the same time expanding and improving the accuracy of the insights energy providers are able to draw upon as part of their grid planning process. AMI analytics enable more accurate predictions of future load patterns, more effective grid-stabilizing customer behavior strategies and more successful management of distributed energy resources.

Historically energy providers have only been able to evaluate energy usage at the substation level, or in some cases, at the feeder level.

Now, by applying AI to smart meter data, utilities are empowered to understand load at the per-home or per-appliance-use level. While all usage may look the same at the substation level, it’s certainly not the same at the home level.

Applying AI to smart meter data, energy providers can define the foundational building blocks of service territory energy use: the consumption of individual appliances within a home. This bottom-up approach to grid management enables a deeper and more granular understanding of usage.

AMI-derived household energy use data enables energy providers to cost effectively create highly accurate and comprehensive appliance-level energy use profiles for every residence. These profiles reveal essential load research data inputs, including such things as:

For example, as soaring temperatures strain grids across much of the northern hemisphere, a precise understanding of HVAC and pool pump usage and appliance health can inform impactful demand response programs that effectively engage customers to better reduce load.

NV Energy approached demand response with these goals in mind.

“We ran into some really good opportunities to target our customers and get the most value out of our customers based on AI-powered intelligence that told us when specific appliances were using more energy than their neighbor’s appliance or than a properly functioning appliance should have been,” explains NV Energy’s DSM Program Delivery Manager Adam Grant. “Maybe there was something wrong with their air conditioner, or we could tell that they had a single speed pool pump vs. a variable speed pool pump. Those insights gave us an opportunity to offer a solution to customers who either have a problem or who don’t have the equipment that is most optimal or most efficient. We could take what we knew about precisely where and why they were inefficient and try to help them become more efficient.”

Using Bidgely’s Analytics Workbench bottom-up load research and customer targeting capabilities, NV Energy piloted an HVAC efficiency program that identified 50,000 customers not already engaged in a utility program who would benefit from HVAC replacement based on certain high HVAC energy usage patterns.

Based on the success of the HVAC program, NV Energy built a similar Energy Efficient Pools and Spa program. Analytics Workbench was used to disaggregate AMI data to reveal pool pump appliance ownership and consumption and identify single speed pool pump owners who had the highest savings potential. The utility targeted this group with outreach to encourage upgrades to more efficient devices. At the same time, they sought to identify which homes were running their pool pump during peak hours as priority targets for the utility’s load shifting initiatives.

“There are 200,000 pools in southern Nevada and only 20 percent of them are efficient so far,” explains Grant. “So we used household energy use data to identify the most inefficient pools with high energy usage pool equipment. We targeted those 75,000 residential customers, telling them, ‘You seem to be using a lot of energy for your pool, we can help you.’ It was incredibly successful.”

Appliance-level insight building blocks can then be aggregated to provide actionable intelligence at both the customer-segment and grid-asset-levels -– such as in connection with a specific feeder or substation.

Bidgely worked with one utility in the Pacific Northwest to leverage disaggregation to map all of its customers to grid assets — first to specific feeders, and then those feeders to substations. The utility’s goal was to assess whether its existing feeder mapping would be able to withstand additional DERs, or if it should consider reconfiguration. Starting by disaggregating the energy use data for every household in the service territory, Bidgely empowered the utility to visualize the load on each of its feeders and other assets, and then assess whether any of the customer sets should be moved to a different feeder to optimize grid operation. This bottom-up approach to load research revealed essential grid management strategies to improve resiliency and avoid unnecessary infrastructure upgrades.

Real-time, AI-powered customer energy use data analytics capture essential aspects of a customer’s energy use behaviors over time, and reveal the variation in customer behavior or occupancy at different points during the year. Customer profiles reflect current household conditions and how they have changed from one month to the next, including the impact of unexpected environmental and societal events.

The ability to track customer energy use on an ongoing and iterative basis makes it possible to identify emerging and growing trends before they impact grid operations to enable more accurate and strategic planning.

For example, in the case of electric vehicle grid planning. AI-powered data visualization allows teams to pinpoint where constraints may exist or develop.

The grid is only going to continue to grow more complex in the years and decades ahead. Those utilities that can tackle this complexity with tools to simplify grid management will remain the most nimble in the face of change. By turning appliance-level energy consumption data into actionable intelligence, utilities can predict future load patterns, encourage grid-stabilizing customer behaviors and successfully manage distributed energy resources.

Learn more about bottom-up grid planning practices by downloading Bidgely’s AI-Powered Data-Visualization Playbook for Load Research and Grid Planning.

In the second episode of Bidgely’s 2022 Engage+ video series, we traveled to Texas to sit down with CenterPoint Energy’s Vice President of Energy Solutions and Business Services Elizabeth Gonzalez Brock to learn more about how the utility’s Reliance Now and EVolve Houston programs have engaged industry and community leaders in developing collaborative solutions to Houston’s greatest energy challenges and inform their grid planning with diverse perspectives.

Watch the full Engage+ episode on demand.

“In the Houston region, we’ve had seven national declared disasters during our current mayor’s six-year administration. We also have a lot of data that tells us that storms are coming with more frequency and more intensity,” said Brock. “An important part of what we do with that information is considering the question of equity versus equality. When we built our system, we built it for equality. We wanted to make sure that all of our customers were treated equally. But equity tells a different story. Not all customers have the same needs. Critical infrastructure like hospitals or grocery stores, and vulnerable low income, elderly and disabled customers and regions that experience the brunt of extreme weather most often experience a greater impact. So just having a good understanding of what our customers’ needs are is really important.”

Brock shared that CenterPoint believes when you’re solving big problems, you don’t solve them on your own. It’s that point of view that guides their approach to building the grid of the future.

“It’s not one company, not one utility, that can solve the problem of resiliency,” she said. “We need to bring our community together and get inputs from various sectors so we know how to best serve them. That’s why we developed a customer advisory panel to help us understand what the critical needs are. And we have used those inputs to inform our business decisions and make sure that we’re thinking about the future the right way.”

When it comes to advice for other energy providers worldwide, Brock said there were several key lessons learned from CenterPoint’s approach.

“First, communication is key. People want to know what happened. People want to know what you’re going to do to fix their problems. They want to know what’s going to be different next time,” she advised. “You also need community advocates. We’re working on building a more resilient city. But in order to do that, we need people to advocate for essential changes and new infrastructure. Finally, you need to be able to agree on how we’re going to optimize our funding. So whether it’s through seeking federal dollars, or whether it’s advocating at the PUC, or at the legislature, or even making our own customer investment. Energy providers need a strategy around how to pay for all these things that we want to do.”

CenterPoint is demonstrating the benefit of this approach through its Resilient Now initiative – working with the City of Houston to create a master energy plan for the city that will preserve its reputation as the energy capital of the world.

“Resilient Now began with a conversation with our largest customer — the city of Houston — about how we can better serve their needs and align our business objectives and goals around their aspirations,” said Brock. “Together we explored what we need to do to ensure a more sustainable future. But also, how do we look at resilience? The “now” piece is crucial. We’re prioritizing shovel-ready projects that can instill confidence from our customers and our region. And we have put together a framework that enables us to communicate together with a united voice when we speak to our customers and the city’s constituents. We’ve gotten a lot of positive feedback about Resilient Now with other stakeholders and communities outside Houston wanting to join and give inputs. It’s another of those huge problems that we’re not going to solve by ourselves, so we need as much input as possible so that we can plan for the future.”

CenterPoint has tackled transportation electrification in the same way.

“We need to understand what our investment requirements are going to be if electric transportation takes off,” emphasized Brock. “You’ve got to think about all the things that can be electrified. Everything from ports, equipment, forklifts, cars, buses, rail — all of that electrification is included are in our C&I, customers’ 2030 goals. Part of the Resilient Now planning process is understanding what our infrastructure requirements will be. But at the same time, we’ve started a nonprofit called EVolve Houston. EVolve Houston is a 501c3 with a mission to improve air quality by enabling electric transportation. Getting our 501c3 for air quality was a huge accomplishment because it hadn’t been done before. We decided to go the 501c3 route, because it was important for fundraising — to be able to get charitable dollars and make it possible for businesses to invest. It is an extra bonus for our commercial partners to be able to use monies from either their foundation or corporate contributions. I absolutely recommend this approach to other utilities because it is a way to support a good cause that aligns very well with your business goals.”

EVolve Houston’s founding members include University of Houston, the City of Houston, NRG, Shell and CenterPoint Energy. A wide range of other transportation electrification stakeholders have also come on board, including BP, Buc-ees travel centers, Uber, the Texas Auto Association, and Houston Metro and the roster continues to grow.

CenterPoint’s stakeholder engagement strategy is serving them well in pursuit of both resiliency and sustainability.

“For example, we’re really excited that the Texas legislature authorized us to develop a load management program,” she said. “If we find ourselves in a situation where we need load, large industrial customers can volunteer to go offline so that we can have that additional capacity to serve residential customers. We have tested the program as part of an initial phase one and we are focused on strategies to sign up a lot of C&I customers, because it’s a volunteer program.”

CenterPoint’s inclusive approach to resiliency, sustainability and grid planning offer valuable lessons for utilities worldwide that are developing their own future-ready strategies. In Houston, inviting diverse stakeholders to co-create and implement unified energy solutions is delivering results that will help Houston reinforce its position as the energy capital of the world.

If you’d like to hear more about the CenterPoint resiliency approach, watch the full Engage+ episode on demand and sign up now to receive updates about future episodes, including episode 3 in July when we will speak with Avangrid’s Customer Programs & Products Manager Charles Spence about Avangrid’s approach to designing an intelligent, analytics-driven EV strategy to achieve long-term transportation electrification success.

We had the chance to speak with Energy Innovation and Resources Officer Emeka Anyanwu, Director of Electrification and Strategic Technology David Logsdon, Senior Manager of Grid Modernization Uzma Siddiqi, Transportation Electrification Portfolio Manager Angela Song to explore City Light’s approach, as well as talk with EPRI Program Manager Jamie Dunckley about the comprehensive electrification assessment conducted by EPRI that is informing much of their approach.

Watch the full Seattle City Light + EPRI episode on demand.

Anyanwu kicked off the conversation by describing the unique Seattle environment that allows his team to think boldly when it comes to serving their community.

“The environment here is welcoming of really forward and aspirational thinking around both environmental justice and racial and social justice,” he explained. “We can do and say things and, and aspire to achieve things in Seattle that would be much more difficult in other parts of the country. It gives our team a sense of purpose, and it dares us to think more ambitiously about how to best serve our communities, improve equity and meet the climate crisis.”

It didn’t take long to see exactly how the bold, community-oriented mindset he described is inspiring CIty Light’s electrification initiatives – first and foremost with the utility’s prioritization of transit electrification over personal EV programs.

“I think what you see in lots of places is that cars are the form of electric mobility that gets the most attention,” Anyanwu said. “There’s a lot of discussion around vehicle charging, and charging access. And those things are certainly important to the electric transportation transition. But we were in a position to choose to prioritize communities that have historically been underserved and underrepresented in these conversations and to make their priorities, not just first, but primary to what we were trying to do. It’s part of our belief that we have a duty to re-envision an energy system that elevates and uplifts communities throughout the Greater Seattle region, but especially those communities that have been historically left out of important conversations and decisions around our energy system. We were able to make a strategic choice that might meet with more resistance in other scenarios. But here in Seattle, we received a lot of support from our policymakers and from our communities for making that choice.”

“It’s very tempting as a utility to approach something like transportation, electrification by hiring a consultant, coming up with a game plan, and then hosting some town halls to say, ‘this is what we’re doing, and aren’t you excited to benefit from it,’” agreed Logsdon. “We wanted to turn that around, and do our outreach from the earliest stages so that the community had a chance to actually give meaningful input to our plan before the plan was fully baked. We wanted to listen and implement what we heard from the community.”

Logsdon said City Light’s outreach included talking with what he called ‘the usual suspects,’ including car manufacturers and electrification supply companies, but that the majority of their outreach focused on Seattle’s environmental justice communities and the stakeholders who represent the residents who live and work in those neighborhoods. This public outreach informed the utility’s Transportation Electrification Strategic Investment Plan (TESIP) which prioritized public transit, expanding access, and greening the fleets that operate through environmental justice corridors.

We saw first hand how transit electrification is proceeding at an accelerated pace, thanks in part to City Light’s partnerships with King County Metro, the Washington State Ferry System and more.

“King County Metro and the Washington State Ferry system are working to switch to battery electric, and that can pose huge loads on the grid,” explained Logston. “King County Metro is electrifying all of their buses by 2035. The waterfront is similar. We’ve got 140 megawatts of load growth on the waterfront. That’s why we’re partnering with them early on to understand how we’re going to charge those buses and ships and are developing innovative plans. We’re looking at peak shifting and battery storage. We’re doing studies about the potential for a network of microgrids for grid resilience. We’re looking at green hydrogen as a potential way to decarbonize maritime onshore. So there’s a lot of different strategies that are emerging. And especially for those load clusters, we really need to look at all of the options, test them, and scale up what works.”

“Over the last year or two, we’ve established a partnership with Washington State Ferries as they see electrification as part of their solution to decarbonize their diesel fuel use,” added Siddiqui. “It’s a large load, and our grid wasn’t designed for that large load. So we are preparing to make changes. We’d like to figure out whether there are different approaches to take. Do we always just do the thing that we’ve been doing for the last 5, 10 or 20 years? For example, one of the ideas we’re exploring is to install a large battery that would make it possible to charge two boats simultaneously – one from the grid, and one from the battery. So about eight times during the day, two boats will come onto the system. That’s a great way of using the system that we have as efficiently as we can.”

“We’re also engaging with all the fleet operators to understand where they will be charging, so that we can plan for that on the grid – because these are big loads,” Logsdon emphasized. “We need to plan for that, starting now. And one of the big fleet operators that we’ve got our eye on is the trucking out of the ports. There are 3,000 trucks that operate out of the Port of Seattle, so we’re trying to figure out how to best start some pilots to understand where we can be effective. And we hear things like, ’you need to add amenities.’ And so we’re looking at how to build hubs that offer what operators are looking for. We know one of the most important things with electrification is that the early experiences are positive.”

Though transit and fleets are the top priorities, City Light is tackling personal EV needs as well. But here too, they are looking at their customers’ needs differently than many other markets. The majority of City Light’s residential customers live in multi-unit dwellings while a minority of their customers have access to a single family garage.

“Another of our areas of focus are multifamily properties and other residential locations without driveways,” explained Song. “That’s our first focus for building electrification, because it’s the toughest to electrify. These buildings were built long ago, so the panel infrastructure behind vehicle charging needs to be looked at and upgraded. It’s hard to electrify.”

When it comes to public charging stations, Song said they are in a pilot phase.

“We’re aiming to install 21 by the end of Q3 2022,” she said. “As with our other transportation electrification plans, our public charging program has been built on a lot of community outreach. We can always lean on the community to tell us where they want our investments. We take their feedback and look at the map and assess where the capacity is.”

In addition to community input, every member of the City Light team pointed to the electrification baseline assessment, which was conducted on their behalf by the EPRI, as a crucial element of their future ready grid planning process.

EPRI’s Jamie Dunkley explained that the assessment laid out several electrification scenarios ranging from ‘business as usual’ to ‘100% electrified’ and examined what it would take to meet each of them – including what transportation and buildings would need in terms of energy and power and what capacity is available on the grid side.

“What was great to see is that there is a lot of available capacity on Seattle’s grid. So they can handle 100% electrification,” said Dunkley. “The bigger challenge is figuring out when and where it’s available. There might be areas where capacity is a little bit more limited. And then areas that might have more capacity. So it’s important to think through what kind of electrification would happen in potentially limited areas, and different management strategies that can be used to make electrification work in those spots without putting in a lot of investment into the grid.”

When it comes to takeaways for other utilities that are in similar situations, Dunkley suggested examining ‘what would it take’ is a really useful exercise.

“Thinking about how much energy is needed, and how much capacity they have, and looking at where there might be a disconnect is useful for any utility when promoting electrification and decarbonization. That baseline empowers you to figure out the strategies to help you get there,” she said.

Siddiqui agreed, “Our assessmentI has been wonderful to help establish the baseline that then helps us to look at what challenges lie ahead. It’s really hard to solve a problem that you haven’t defined. Now we know – what does the load look like? What does transportation electrification load look like? What does building electrification load look like? And we can layer on solutions on top of those insights, and that’s really how we’re going to solve the challenge of this new grid.”

“A new era is emerging with utilities,” concluded Logsdon. “We are keeping the focus on reliability, affordability, safety that has always been there. But it requires new investments to maintain reliability because we’ve got the load growth coming from electrification. We need to start investing in new ways to prepare for that new resource. And resilience is a key aspect. We’re expanding the services we provide to our cities. If there’s an outage, we have to ensure there is some way for people to fuel their cars and keep the ferries and buses operating. And that’s a big ask for electric grid modernization. If we’re going to maintain reliability and resilience, it’s crucial we bring new resources to the mix.”

I think Anyanwu got it right. What Seattle City Light is doing with electrification does in fact represent some of the industry’s boldest thinking. If you’d like to hear more from the City Light and EPRI teams about the innovations underway in Seattle, watch the full Engage+ episode on demand and sign up now to receive updates about future episodes, including episode 2 in June when we will travel to Texas to talk with CenterPoint Energy about grid resilience.

When analytics are applied to Advanced Metering Infrastructure (AMI) data, the resulting intelligence serves as an essential input to rate design calculations, delivering more effective rate structures that better satisfy utility objectives.

New Hampshire Electric Cooperative’s (NHEC)’s experience developing AMI analytics-based rate design provides an example of the power and potential of this approach.

While many utility rates are designed to encourage customers to modify their behavior by shifting energy use to lower cost hours (i.e. time of use rates), NHEC approached Bidgely with a different objective. NHEC sought to offer existing segments of its member base (NHEC’s customers are ‘members’ of the cooperative) lower overall rates because their current time of use consumption was less expensive to serve. In other words, NHEC sought to proactively reward members who demonstrated positive power use behaviors rather than incent those who demonstrated negative behaviors to use energy differently.

To achieve NHEC’s objective, Bidgely employed an innovative data science technique known as unsupervised learning.

Starting with our patented AI-powered load disaggregation solution to itemize 100 percent of residential member loads, Bidgely was able to provide NHEC with visibility into member’s usage patterns at both whole-home and appliance levels. This advanced data science enabled NHEC to explore opportunities to design rates that better aligned with member usage patterns.

Bidgely’s Analytics Workbench business intelligence platform analyzes AMI meter data and supplemental utility-contributed member data to generate up-to-date analyses of major appliance ownership, usage in kWh (including time of use) and additional attributes such as major appliance power draw in kW.

Using Analytics Workbench, Bidgely expanded upon disaggregation to deploy unsupervised learning algorithms to identify clusters of members who fell into patterns of electricity use by annual consumption, seasonal consumption, and even daily consumption.

For example, the advanced data science identified members who had high summer loads or high winter loads. It also identified members who fell into certain daily patterns, such as early birds, afternoon peakers and night owls.

In total, the unsupervised learning clustering analysis identified 14 unique lifestyle-specific clusters among NHEC’s membership.

We then worked with NHEC to ingest their cost-to-serve data into the platform, which included cost-per-hour data for the course of an entire year. With this data, Analytics Workbench was able to determine the cost to serve each member cluster at a specific time.

Next, NHEC looked at whether they could offer one or more of the low-cost-to-serve member clusters a discount on their rate without unfairly affecting the remainder of their service population. Bidgely’s analysis revealed that NHEC could offer four member clusters a lower rate without adversely impacting other members.

New Hampshire Electric Cooperative is a cooperative, but there are still lessons to be learned for traditional IOUs. The same principles of rate design can apply as regulated utilities work toward approval of a rate case.

First, it’s essential to understand the unique segments that exist within a service population, including their time of use and usage patterns. It is also important to take into consideration the cost to serve each individual customer. No matter the business model, leveraging AMI data empowers utilities to design innovative and modern rate structures.

Rate design has always been the foundation of the relationship between utility and customer. However, before AMI data became available, the number of rate structures was limited. Now with the benefit of AMI-derived customer intelligence, it is possible to design a wide-range of rate structures to better fit diverse customer segments. As a result, customers are better able to understand the value they receive from their energy provider, and utilities are better able to achieve their business objectives.

Learn more about NHEC’s advanced analytics-based rate design experience by downloading the full case study, and read more about Analytics Workbench in our solution brief.

Their discussion centered upon how energy providers are changing the utility-consumer dynamic to increasingly rely on their customers as partners in ensuring a resilient and decarbonized grid.

“It was not that long ago that electric utilities routinely referred to customers as loads or ratepayers,” said Warren. “It’s not that utilities haven’t always cared about their customers. After all, the fundamental mission of utilities has long been to reliably deliver the electricity that homes and businesses needed. But they focused their time and resources keeping the grid working – because when they did, customers were happy.”

But now, as the power system dramatically transforms to become more distributed and support electric technologies like electric vehicles, the significance of energy customer engagement is evolving as well. More and more customers are feeding electricity back onto the grid and their energy usage patterns are changing.

For customers to play an integral role in the energy transition requires a deep understanding of how customers use electricity, which technologies they’ve adopted, and the types of utility programs that could benefit them. These granular insights make possible more effective communication, deeper engagement, greater customer satisfaction, and ultimately, a true partnership relationship.

Approximately 75 percent of US homes now have a smart meter. In the past, when a utility read a customer meter once a month, there wasn’t a great deal of insight available about how a household used electricity or what appliances they had installed. But the level of insight into customers that’s available now is enormous. Instead of monthly reads, smart meters provide data about customer electricity usage every 15, 30, or 60 minutes.

“Smart meters can provide utilities with the granular information they need to understand customer electricity usage,” said Warren. “If that information is analyzed and understood, utilities can proactively communicate with customers to give an incentive to become partners in creating a grid that is decarbonized and reliable.”

“Let’s think about what these trends mean for utilities. At one level, a large and quickly increasing number of distributed energy resources makes customers a very important part of the grid. For instance, the time of day that EV owners charge their vehicles can have a significant impact on a utility’s ability to meet peak demand,” said Warren.

“For utilities interested in a more personalized approach to communicating with their customers, this data is invaluable. It’s an opportunity for utilities to understand their customers and how they use electricity in a way that has never been possible before,” added Kretzing. “But in most cases, utilities haven’t changed their engagement models to take full advantage of the customer insights available.”

A large part of the disconnect between the now-available data and data-informed customer engagement is that useful insights don’t flow automatically out of the smart meter. The raw data has to be analyzed and understood before energy marketing teams can use it effectively.

That’s where Bidgely’s patented data science comes in – applying AI-powered algorithms to smart meter data for all customers to produce an accurate and continuously updated appliance-level view of how every household consumes electricity.

“We’ve developed a solution called Analytics Workbench that can help a utility understand when a house is running its HVAC system, pool pump, or washer or dryer,” explained Kretzing. “Our AI-powered analytics can also identify which homes have an EV and when they charge it, and the impact of solar generation at a household level. For instance, someone may be running their air conditioning unit while their solar is more or less offsetting that load. We can see that in AMI data, and with Analytics Workbench, utilities can easily discover those insights as well.”

She went on to emphasize that “all of this household and appliance-level information can be gathered without having to ask a homeowner a single question. It can be deployed quickly and at scale. And it can be used to both better serve customers and achieve utility objectives around customer engagement.”

“One of the big challenges marketers have faced is that they have had to craft and deliver messages to a broad cross-section of customers. Some of those customers may be keenly interested in the program or incentive you can provide, while it may not deliver any value at all to others,” explained Kretzing. “For example, an EV charging rate or an incentive for a Level 2 charger is of little use to someone who doesn’t have an EV. AMI data and analytics allow utilities to move away from using a single message for all customers to specifically targeting only those customers who will get the most value out of a given offer and program.”

With AMI data and analytics, it’s possible to quickly segment customers to identify those who are best suited for a special rate or offer. For example, it can be helpful for utilities to identify customers who use the most air conditioning at times of peak demand in order to prioritize them for enrollment in a demand response program.

“It’s not just about targeting the right customers,” Kretzing emphasized “Marketers can also take advantage of the customer data they collect to personalize their communications to make them more effective and engaging. For example, a utility could educate a customer about exactly how much energy their household is using during times of peak demand and quantify how much it is costing them. Then they could point out what a customer would save if they enrolled in demand response.”

Warren and Kretzing went on to talk about the urgency of putting AMI-informed segmentation and personalization to work in response to the increasing adoption of EVs.

“Once you have used AMI analytics to identify who your EV owners are, you can do a little more digging to understand their behavior better,” said Kretzing. “As we know, EV charging represents a big opportunity for utilities to shift their load. What AMI and analytics can reveal is when EV owners are charging their cars, and more specifically, which customers are charging during peak times. Marketers can then craft messages to those specific customers who are charging on-peak to let them know about the time of use or EV-specific rates, and include personalized insights about how much a customer would save by shifting their charging to off-peak times or taking advantage of a time of use rate.”

“Precise targeting and personalized messages are critical to effective marketing, but AMI data and analytics also allow marketers to more or less measure the effectiveness of their initiatives in near real-time,” said Warren.

“That’s exactly right,” agreed Kretzing. “Think about the limited capacity marketers have to measure the effectiveness of their work today. For the most part, it comes down to the conversion rate — in other words, the number of consumers who actually enroll in the programs and incentives they are marketing. For example, after defining a segment to target for a demand response program, marketers can deliver personalized messages to that group of customers and then use Analytics Workbench to monitor customer behavior on a daily basis. If the enrollment isn’t what a utility hoped for, marketers can do a couple of things. One is they can adjust their communications to the target audience to boost engagement. Or they can select a different target segment to see if those customers are more receptive to the outreach. Utilities can even take advantage of insights about past customer engagement. That can be used to define new segments so that utilities are reaching out to their most engaged customers.”

This real-time measurement and verification is a powerful tool to layer onto traditional M&V studies, which can be robust but tend to be done only after a campaign is complete. What Bidgely’s Analytics Workbench provides is a tool for marketers to continuously assess the effectiveness of their campaigns and adjust them based on what they are observing, ensuring more successful outcomes.

Interested in Learning More? The entire conversation between Warren and Kretzing is now available as an on-demand webinar. And, read more about how Analytics Workbench empowers DSM program marketing.

Most of them have had corporate strategies to meet climate imperatives in place for a while, and long before COP26. These companies are deeply invested in diversifying their energy sources, embracing energy efficiency, evolving their business models, and fully transitioning. They are leading by example.

At the same time, utilities and energy suppliers play a critical role in the net-zero economy as they are also enablers for their customers’ (commercial, industrial, and residential) own decarbonization targets. Consumers themselves are realizing that the way they use energy is proving to be unsustainable. They are actively seeking to be part of the solution and to be more engaged, which is increasingly possible as everything becomes more interconnected. Digital creates a foundation to empower the customer to become part of the change.

In a recent IDC Energy Insights survey, 41% of European utilities identified sustainability and risk management as one of their top strategic business priorities. Among these utilities, 55% identified energy efficiency as the key initiative they are implementing to execute on their strategic business priorities.

At the same time, European energy suppliers identified product and service innovation as their top strategic priority, with 55% of them identifying energy efficiency and energy as a service for C&I customers as key initiatives.

The common theme is energy efficiency, which remains a cornerstone of reaching carbon neutrality. According to the IEA, “Net zero by 2050 hinges on a global push to increase energy efficiency.” Optimizing energy consumption entails understanding how energy is consumed, and then taking action. Providing personalized insights is critical for meaningful customer engagement. No one is in a better position to do so than utilities that are already measuring and quantifying energy usage. As an example, 91% of TEPCO customers find Bidgely Home Energy Reports useful or very useful, and 66% have followed UtilityAI-informed rate plan recommendations, reinforcing deeper customer engagement. Considering the challenging market conditions for utilities and energy suppliers, they need to make capital out of AMI data by extracting value through data analysis and insights.

With energy analytics, utilities can have a more targeted approach when it comes to identifying which customers would best respond to time of use tariffs; tied to the detection of electric vehicles, this can unleash significant benefits in terms of flexibility along the entire utility value chain.

Energy analytics can also provide unique information on which customers have a higher propensity to buy specific products. Additional energy disaggregation can also offer customers valuable information about their appliances. This information, tied to an energy marketplace, can become a concrete revenue stream for energy suppliers that have been struggling with cash flow for years. In fact, energy efficiency initiatives are a key tool for energy suppliers to mitigate the impact of rising wholesale energy prices on their bottom lines.

When it comes to net zero, utilities need to charge beyond their own journeys. There are myriad opportunities for utilities to reinvent themselves as energy (efficiency) advisors, creating long-term value for both themselves and their customers.

For more industry insights from IDC, download their latest IDC MarketScape: Worldwide Digital Customer Engagement Solutions for Utilities 2021 Vendor Assessment (IDC # US46149620, June 2021).

| About IDC International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications and consumer technology markets. IDC helps IT professionals, business executives, and the investment community make fact-based decisions on technology purchases and business strategy. More than 1,100 IDC analysts provide global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries worldwide. For 50 years, IDC has provided strategic insights to help our clients achieve their key business objectives. IDC is a subsidiary of IDG, the world’s leading technology media, research, and events company. |

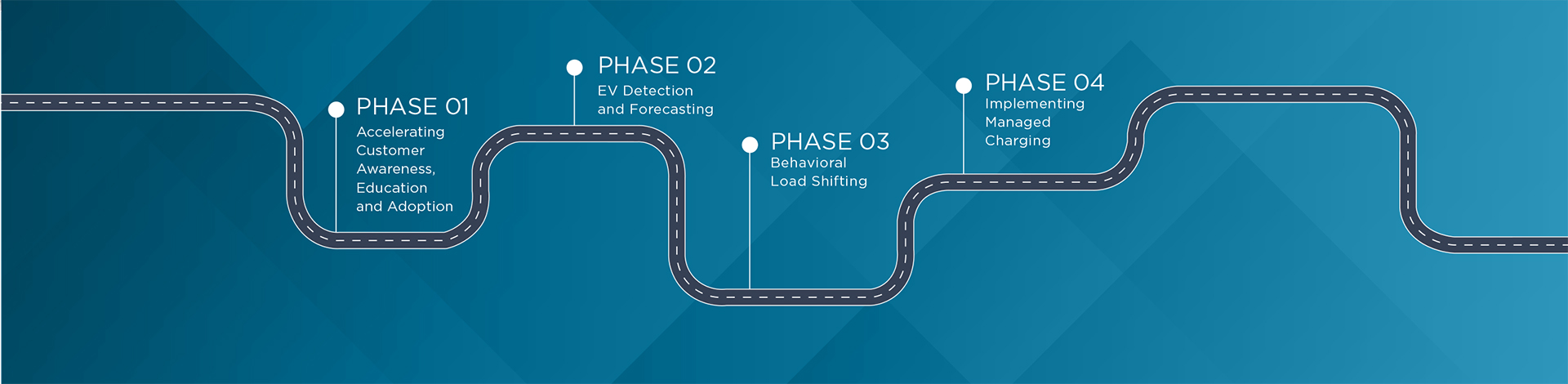

At Bidgely, we often describe the electric vehicle adoption curve as a four-phase journey.

Phase 1: Accelerating Customer Awareness, Education and Adoption is the starting point.

McGrade agreed.

“Here’s where you can leverage some of the inherent trust that utilities have,” he said. “You’re not selling cars, but instead are there to help answer any questions that consumers might have about the vehicles.”

“What we’re seeing within our research is there’s a substantial knowledge gap for consumers around electric transportation. Individuals are seeing EVs as they would any other car. And they’re not. It’s a different technology,” he said. “Consumers have a lot of questions – whether they’ve already made the investment in an EV or are considering a purchase in the future.”

McGrade said the knowledge gap runs the gamut, including questions about how an EV differs from a typical combustion engine, when to change the oil, how many miles to the ‘gallon’ they get and more. But Wood said oftentimes consumers are also wondering about things that you don’t find on any standard FAQ.

“At Southern, we had an EV awareness program a few years ago called ‘Coffee and Cars’ where we rented out a coffee shop and invited customers to visit. In addition to having several models of EVs on display, an EV concierge was on hand to answer any questions they wanted to ask,” Wood explained. “We were down on the coast, and one of the questions that we got was whether salt air impacted EV batteries in the same way that ocean climates sometimes cause vehicles to rust. The answer is no — there is no effect on the battery. But it’s an example that’s always stuck with me about the wide-ranging questions that are on consumers’ minds.”

“We see a ton of opportunities for utilities to fill that knowledge gap,” said McGrade. “Our recent survey on electric vehicles revealed, for example, that individuals don’t necessarily understand the difference between electric vehicle types, such as hybrids, plug-in’s and full battery operated vehicles. The same holds true for charging networks and the types of chargers that exist. Consumers have no idea what exactly each one consists of, or which type fits for their individual use case. This is where energy providers have an opportunity to step in as a trusted source and say, ‘based on your driving pattern, this is the right charger for you.’”

“One concern I hear often is related to what happens during a power outage. ‘I won’t be able to charge my car.’ they say. But what people don’t consider, is that during an outage, the gas pumps won’t work either,” said Wood.

“There is definitely a lot of misguided logic out there,” agreed McGrade. “‘You can’t drive it cross-country’ is another one. Well, you can’t drive a combustion engine cross-country, either. You still have to stop for fuel. There is no 3,000-miles-to-the-gallon commercially available vehicle.”

Wood and McGrade were also quick to emphasize that the energy providers’ opportunity and obligation to provide education and guidance doesn’t end with the vehicle purchase. In fact there is a great deal of increased support that’s necessary once customers drive home after their purchase.

“Energy providers continue to have an opportunity after a customer makes that purchase and rolls off the lot,” said McGrade. “It’s in the utility’s best interest to make sure that the consumer’s ownership experience after that initial investment is as easy and as streamlined as possible to encourage overall adoption going forward. For example, there are conversations to be had about the best rate plans to avoid high bill shock and charging best practices. You don’t want new drivers to end up under duress because their bills are high or their experience is otherwise different from what they were promised. And you don’t want an individual coming home and plugging in and charging in such a way that they cause issues with the whole neighborhood, because that’s going to be a deterrent for future growth.”

For energy providers to truly position themselves as trusted EV buying advisors and lean into pre-purchase customer engagement, personalized marketing that aligns with each customer’s needs, motivations and values is essential.

Bidgely’s patented disaggregation and machine learning technology allows each prospective EV buyer touchpoint to be hyper-personalized based on their own energy use profile and customer persona.

With this approach, mass marketing is replaced by customized, targeted messaging that more effectively alleviates consumer anxieties and fills each customer’s unique knowledge gap.

Recognizing that every customer has unique decision factors, Bidgely’s EV Solution delivers “personalized nudges” that provide EV information that aligns with their specific interests, such as the number of electric vehicles adopted in their community, an ROI calculator that evaluates what a purchase would mean for them, or social comparisons.

Then, post-purchase, personalized engagement insights continue through EV Journey Phases 2-4:

Our EV Solution sets drivers up from the start to manage their EV charging and elevate their ownership experience with regular summaries of their charging activity and cost of ownership; behavioral charging and equipment recommendations; and promotions for relevant programs, incentives and rebates.

At every stage of the EV adoption life cycle, Bidgely empowers energy providers with data-driven and customer-specific energy insights to foster the engagement and collaboration necessary to optimize EV ownership for both drivers and energy businesses and advance transportation electrification at scale.

“As you look toward any utility strategy around electrification, and in particular, electric vehicles, the opportunity to educate really has to be pushed,” emphasized McGrade. “You don’t need to be the car salesman. Instead be that trusted source who provides knowledge and understanding around these types of technologies and educates consumers about the process in such a way that provides benefit to all parties. The opportunity to educate has to be built into any strategic plan.”

“Ultimately, it all comes back to the consumer,” says Wood. “At the end of the day, we need to be focused on the person driving in the vehicle. The interest is there, and we need to supply it.”

“Beyond just increasing EV adoption, our research shows that EV drivers have a high degree of satisfaction around the purchase – which is likely to lead to more interest in other forms of at-home electrification” says McGrade. “And so from a utility standpoint, there is further opportunity for engagement to help guide consumers to additional electrification opportunities. It’s a whole new gateway into the home and a chance to build on that EV relationship.”

Hear my full conversation with Jason McGrade and Lincoln Wood in our on-demand webinar entitled Driving a Consumer-Centric EV Strategy: Barriers, Unknowns, Risks, and Rewards, and learn more about the four data-driven phases of EV adoption, starting with accelerating customer awareness, education and adoption.

This vision extends to transportation electrification initiatives – both designing incentives and other programs to help ensure EVs are attainable for everyone as well as prioritizing the deployment of charging infrastructure in traditionally under-served communities. Though equitable outcomes are the primary drivers, ensuring universal access to EV ownership is also integral to growing and accelerating EV adoption across the board.

“We’re working diligently to increase minority participation in our electric vehicle, energy efficiency and solar programs,” says William Ellis, Regional Vice President of External Affairs at Pepco. “Our commitment to our communities is well recognized, but now we are taking it a step further. We’re actively seeking to understand, address and remove the barriers that are preventing some of our customers from participating – whether those barriers are financial, cultural, educational awareness, or even public policy. And we want to ensure that our most vulnerable customers – those who need our programs the most – are able to realize benefits that they’ve been promised so that all of our communities can thrive.”

If energy providers could, they’d have one-on-one conversations with every customer and get to know them — who they are, their values, their preferences, and how they can provide the best possible service. Of course, that’s not realistic, but in many ways, data can serve as a powerful proxy for the customer voice, helping to ensure that the clean energy future is informed, inclusive, trusted, and truly sustainable

Ellis agrees, saying that the foundation for successfully removing barriers to participation is data analytics.

“We’re taking a data-driven approach that we call ‘total marketing’ which looks at demographic, geographic and other participation data to identify the unique needs of all customers as a means to make certain that customers who have historically been underrepresented in our programs are able to take part moving forward.”

Bidgely is partnering with energy businesses worldwide to provide precisely that type of 360° consumer profile for every customer in a service territory to enable meaningful, inclusive EV and other clean energy transition program designs.

Conventional tools such as mass surveys, focus groups and manual utility population data collection take time, are static, lack granularity, don’t update consistently and fail to account for behavioral and lifestyle aspects in their models.

Bidgely instead builds a much more holistic and accurate 360° profile of every customer by analyzing raw energy consumption AMI data using sophisticated machine learning and statistical solutions to pinpoint essential attributes that describe people’s behavior, lifestyle and other characteristics. These hyper-personalized customer profiles enable more effective and engaging education and program recruitment.

Ellis says personalized messaging is essential to foster trust. “A quote I always come back to is ‘people don’t care what you know, until they know that you care.’ And that’s the same with our marketing. Our customers have to have confidence in what we say and see us as a trusted energy advisor, which stems in large part from making sure every customer is able to see themselves in the marketing that we produce.”

Accessible infrastructure is also an integral part of transportation electrification equity. With that in mind, Pepco is simultaneously pursuing residential and public EV infrastructure solutions.

“We first started with our residential EV program, which offers rebates to help customers install level two chargers at home to optimize home charging and make it easier for them to charge off peak – which reduces grid build out,” says Ellis. “We also have our multi-dwelling program that aims to reduce barriers for our rental population to purchase EVs and our public EV charging program to encourage overall EV adoption.”

Bidgely’s Analytics Workbench provides utilities with the EV analytics they need to inform both residential and public charging infrastructure planning and programs. This is done by locking down who, what, where and how much of electric vehicles. It’s essential to understand EV driver behaviors and when charging is occurring across the territory as a means to connect the 360° view of the grid with those of all customers to create a holistic grid + customer 360° analytic view. This comprehensive 360° perspective enables better decision-making about grid planning, real time operations, and customer programs that would be advantageous to introduce.

Like Pepco, ConEdison is pursuing a similar holistic and data informed approach to EV infrastructure planning.

“We’re doing a demonstration project with the New York City Department of Transportation and our partner Flow to bring 100 chargers to curbsides all over the five boroughs of New York City to open up new opportunities for EV drivers to park on the street and be able to charge their cars. Once the demonstration is shown to be successful, this is going to be an infrastructure game changer for New York, considering our population,” says Raghusimha Sudhakara, Con Edison’s Director of EV Demonstration Projects. “Another example, given our demographic and where our customers live, is our efforts to increase access to large charging hubs. As part of our Power Ready program, we just completed a new hub in Bed-Stuy in Brooklyn that features 25 fast chargers In a repurposed industrial building. This is phenomenal, because it’s bringing charging to underserved communities, including several New York City Housing Authority multi-family buildings and a major hospital. Plus, our data has revealed that many of our rideshare drivers live in that area. Roughly half of all rideshare rides in the city either start or end in the surrounding community, so having a facility like the EV charging hub makes a very big difference in providing options close to home where they can charge their cars. And the fact that it’s open to the public really makes a difference to the whole community around it.”

ConEdison is also implementing incentive programs to encourage installation of both residential and public chargers in underserved neighborhoods.

“If someone makes a decision to install a charger in a disadvantaged community, we give a higher level of incentive,” saysSudhakara. “ In that way, our programs are designed to drive the market in certain directions to ensure we cover the majority of our territory, and bring the benefits of transportation electrification to everyone without leaving anybody behind.”

Hear more about how equity is driving transportation electrification programs and planning at Pepco, Con Edison and other utilities by watching their on-demand sessions from the 2021 Engage Virtual conference, and download our solution briefs to learn more about Analytics Workbench and Bidgely’s EV Solution.

Ai is still evolving and may not be perfect. Always verify important details for accuracy.